PSD2 Open API

You can download API Definition here

You can download API Specification here

Introduction

The revised Payment Services Directive (PSD2) is a data and technology-driven directive which aims to drive increased competition, innovation and transparency across the European payments market, while enhancing the security of Internet payments and account access.

Among others [PSD2] contains regulations on new services to be operated by so called Third Party Payment Service Providers (TPP) on behalf of a Payment Service User (PSU). These new services are

- Payment Initiation Service (PIS) to be operated by a Payment Initiation Service Provider (PISP) TPP as defined by article 66 of [PSD2],

- Account Information Service (AIS) to be operated by an Account Information Service Provider (AISP) TPP as defined by article 67 of [PSD2], and

- Confirmation on the Availability of Funds Service (FCS) to be used by a Payment Instrument Issuing Service Provider (PIISP) TPP as defined by article 65 of [PSD2].

To implement these new services (subject to PSU consent) a TPP needs to access the account of the PSU. The account is usually managed by another PSP called the Account Servicing Payment Service Provider (ASPSP). To support the TPP in accessing the accounts managed by an ASPSP, each ASPSP has to provide an "access to account interface" (XS2A interface).

Responsibilities and rights of TPP and ASPSP concerning the interaction at the XS2A interface are defined and regulated by [PSD2]. In addition, more detailed requirements for the implementation and operation of the XS2A interface are defined by [EBA-RTS].

Key objectives:

- Contribute to a more integrated and efficient European payments market

- Improve the level playing field for payment service providers (including new entrants)

- Make payments safer and more secure

- Protect consumers

- Encourage lower prices for payments

Basis of the regulatory requirements are the following documents:

- Payment services (PSD2) - Directive (EU) 2015/2366

- Regulatory Technical Standards (RTS) on strong customer authentication (SCA) and secure open standards of communication (CSC)

- Local transposition law: “Zakon o platnom prometu” (ZPP), published in the official gazette 66/2018 on the 20th of July 2018.

Berlin Group NextGenPSD2

The NextGenPSD2 Initiative is a dedicated Task Force of the Berlin Group with the goal to create an open, common and harmonised European API (Application Programming Interface) standard to enable Third Party Providers (TPPs) to access banks accounts under the revised Payment Services Directive (PSD2). In a unique partnership, participants in NextGenPSD2 are working together with the common vision that open and harmonised PSD2 XS2A interface standards for processes, data and infrastructures are the necessary building blocks of an open, interoperable market. True interoperability is an essential component of competitive pan-European PSD2 XS2A services and will contribute to further progress towards the European Single Market and benefit the payments industry in general and European consumers and businesses in particular.

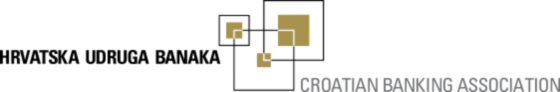

While a harmonised XS2A interface is essential to enable XS2A services to mature at scale and at relatively low cost, the full PSD2 XS2A ecosystem covers other technical, functional, operational and governance domains with (sometimes optional) complementary services as well, as displayed in the following picture:

Key characteristics of the NextGenPSD2 Framework:

- Modern “RESTful” API set using HTTP/1.1 with TLS 1.2 (or higher) as transport protocol

- Integrating public market consultation feedback on a first draft version

- TPP identification by ETSI viii -defined eIDAS certificates: QWACS mandated (easy measure to protect e.g. against DDOS attacks), QSEALS optional for banks (TPP follows instruction by bank)

- Supporting all PSD2 required payment initiation, account information and confirmation of funds use cases, with future-dated, multiple/bulk, and recurring payments optional (depending on support in online banking or in national legislation)

- Full multicurrency support of accounts

- Four architecture models for Strong Customer Authentication (SCA): redirect, OAuth2, decoupled and embedded, with influence of the TPP on redirect preference

- Multilevel SCA approach for corporates, e.g. to support a 4-eyes principle

- Support of card transactions reconciliation accounts

- Signing baskets as signing vehicles for grouped transactions (instead of multiple payments functions)

- Transparent resource structures (allowing TPPs to keep an overview also in complex business processes)

- Dedicated consent API separating consent handling from account access, obeying both PSD2 and GDPR requirements

- Optional session support (set of consecutively executed transactions), subject to appropriate customer consent

- Data structures either as (dependent on retail vs. corporate requirements)

- JSON with data model based on ISO 20022, or

- XML with pain.001 for PISPs and camt.05x for AISPs

- Integrated formal and transparent change management process and versioning

- Extensible with additional extensions that allow to build (non-core PSD2) value add services

For further details see NextGenPSD2 overview here.

Croatian Banking Association joined Berlin Group in September 2017. Even thou at that time in early stages, NextGenPSD2 has been seen as an initiative that could bring missing common API standard among credit institutions. Today, Berlin Group API standard is seen as dominant PSD2 API standard initiative backed by credit institutions throughout entire EU.

Member Banks in Croatian Banking Association PSD2 Initiative

Addiko Bank d.d.

Agram banka d.d.

BKS bank AG

Croatia banka d.d.

Erste&Steiermärkische Bank d.d.

Hrvatska Poštanska Banka d.d.

Istarska Kreditna Banka Umag d.d.

J & T Banka d.d.

Karlovačka banka d.d.

KentBank d.d.

OTP Banka d.d.

Partner banka d.d.

Podravska banka d.d.

Privredna banka Zagreb d.d.

Raiffeissenbank Austria d.d.

Sberbank d.d.

Zagrebačka banka d.d.

API Documentation

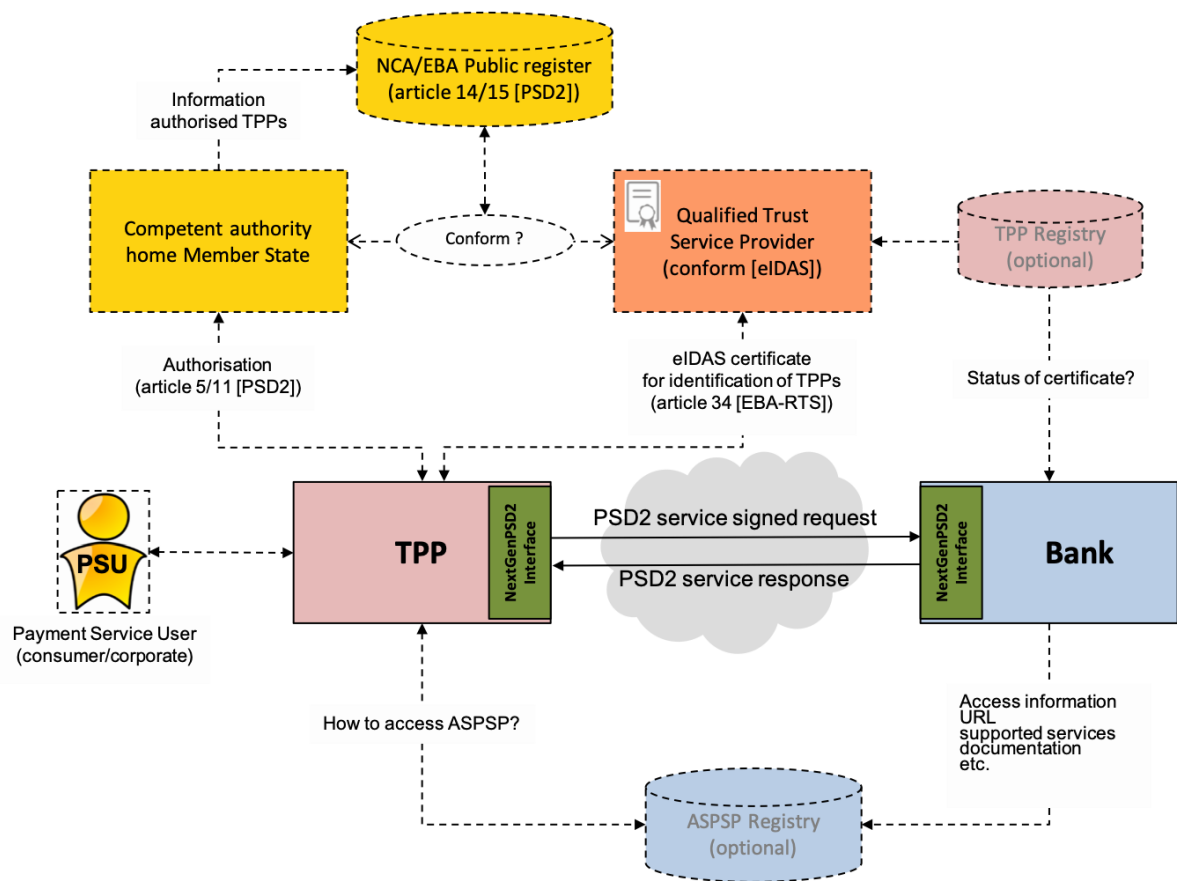

As a member of Berlin Group, fundamental documentation related to PSD2 API in Croatian is NextGenPSD2 documentation. CBA PSD2 documentation arises from NextGenPSD2 API documentation.

Structure

PSD2 API documentation for Croatian market can be divided into three hierarchical sections:

- NextGenPSD2 API documentation

- CBA PSD2 API documentation

- ASPSP’s documentation

Dependencies between each documentation group are described on following graphic

NextGenPSD2 API Documentation

The NextGenPSD2 Framework itself is built of 5 artefacts, which are all published for free under Creative Commons (CC-BY-ND):

- An Introductions Paper

- An Operational Rules document that covers the service description, abstract (logical) data model and detailed process flow descriptions in a B2B interface

- Implementation Guidelines that specify the XS2A interface in technical detail, including XML/JSON schemas

- Domestic Payment definition

- An OpenAPI file that helps implementers during development

The documents are used by banks and TPPs for implementing PSD2-required bank account access.

The most recent release of the NextGenPSD2 Framework can be downloaded here.

CBA PSD2 API Documentation

Latest version of CBA PSD2 API documentation is 1.1 and can be found here. Version 1.1 is referenced to NextGenPSD2 Implementation Guidelines 1.3.8.

Archive versions are located here.

ASPSP’s Documentation

|

ASPSP Name |

PSD2 API Documentation URL |

|

Addiko Bank d.d. |

|

|

Agram banka d.d. |

|

|

BKS Bank AG |

|

|

Erste&Steiermärkische Bank d.d. |

|

|

Hrvatska Poštanska Banka d.d. |

|

|

Istarska Kreditna Banka Umag d.d. |

|

|

Karlovačka banka d.d. |

|

|

OTP Banka d.d. |

|

|

Partner banka d.d. |

|

|

Podravska banka d.d. |

|

|

Privredna banka Zagreb d.d. |

|

|

Raiffeissenbank Austria d.d. |

|

|

Sberbank d.d. |

|

|

Slatinska banka d.d. |

|

|

Zagrebačka banka d.d. |

ASPSP documentation without dedicated API interface.

|

ASPSP Name |

PSD2 Modified Interface Documentation URL |

|

KentBank d.d. |

|

|

J & T Banka d.d. |

|

Documentation Lifecycle

According to RTS: “…account servicing payment service providers shall ensure that, except for emergency situations, any change to the technical specification of their interface is made available to authorised payment initiation service providers, account information service providers and payment service providers issuing card-based payment instruments, or payment service providers that have applied to their competent authorities for the relevant authorisation, in advance as soon as possible and not less than 3 months before the change is implemented.”

In order to be up-to-date with latest documentation we encourage TPPs to subscribe to any documentation changes that may affect API. All changes to API’s will be announced according to RTS rules.

Subscribe to NextGenPSD2 documentation changes here.

Subscribe to CBA PSD2 API documentation changes here.

For subscription to ASPSP API documentation changes see ASPSP’s documentation section.

Linked Documents and References

|

[X2A-ImplG] |

NextGenPSD2 XS2A Framework, Implementation Guidelines, The Berlin Group Joint Initiative on a PSD2 Compliant XS2A Interface, version 0.99, published 02 October 2017. |

|

[eIDAS] |

EU Regulation No 910/2014 of the European Parliament and of the Council of 23 July 2014 on electronic identification and trust services for electronic transactions in the internal market and repealing Directive 1999/93/EC |

|

[PSD2] |

Directive (EU) 2015/2366 of the European Parliament and of the Council on payment services in the internal market, published 25.11.2015 |

|

Open API |

https://swagger.io/specification/] |

|

EBA RTS |

Opinion of the European Banking Authority on the implementation of the RTS on SCA and CSC from 13 June 2018 |

|

EBA Guidelines |

Guidelines on the conditions to be met to benefit from an exemption from contingency measures under Article 33(6) of Regulation (EU) 2018/389 (RTS on SCA & CSC) |

|

EBA eIDAS |

Opinion on the use of eIDAS certificates under the RTS on SCA and CSC |

Abbreviations

|

Abbreviation |

Description |

|

AIS |

Account Information Service according to article 4 (16) of [PSD2] and as regulated by article 67 of [PSD2]. |

|

AISP |

Account Information Service Provider offering an AIS to its customer. See article 4 (19) of [PSD2]. |

|

API |

Application Programming Interface. |

|

ASPSP |

Account Servicing Payment Service Provider providing and maintain a payment account for a payer. See article 4 (17) of [PSD2]. |

|

CBA |

Croatian Banking Association |

|

EBA |

European Banking Authority |

|

eIDAS |

Electronic Identification, Authentication and Trust Services |

|

IAM |

Global architectural component that Manage the Identity & Access |

|

OAuth2 |

This protocol, which allows third-party applications to grant limited access to an HTTP service. |

|

PIISP |

Payment Instrument Issuer Service Provider according to article 4 (14) and 45) of [PSD2]. A PIISP can use the service "Confirmation on the availability of funds" as regulated by article 65 of [PSD2]. |

|

PIS |

Payment Initiation Service according to article 4 (15) of [PSD2] and as regulated by article 66 of [PSD2]. |

|

PISP |

Payment Service Provider offering a PIS to its customer. See article 4 (18) of [PSD2]. |

|

PSP |

Payment Service Provider according to article 4 (11) of [PSD2]. |

|

PSU |

Payment Service User according to article 4 (10) of [PSD2]. |

|

RTS |

EBA Regulatory Technical Standards on strong customer authentication and common and secure communication. |

|

SCA |

Strong Customer Authentication – authentication procedure based on two factors compliant with the requirements of [PSD2] and [EBA-RTS]. |

|

SCT |

SEPA Credit Transfer. |

|

SDD |

SEPA Direct Debit. |

|

TPP |

Third Party Provider – generic term for AISP/PIISP/PISP. |

|

X2A |

Access to Account interface – interface provided by an ASPSP to TPP for accessing accounts. (= API / interface) |